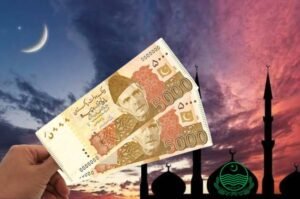

The governor of State Bank of Pakistan Jameel Ahmad confirmed that designs for the country’s new currency notes have been finalised at a meeting of the Senate’s Standing Committee on Finance.

He said that the State Bank Board had approved the designs and sent them to the Ministry of Finance for final approval.

Governor Ahmad made it clear that the new notes will be issued only on the basis of receiving formal consent from the federal government.

He also dealt with issues related to the Rs5000 note and assured the committee that there is no plan as yet to discontinue Rs5000 notes.

Concerns Over Tax Burden

During the meeting of the Senate’s Standing Committee on Finance, the issue of super tax was raised by Senator Abdul Qadir who posed serious questions on it.

He asked himself how citizens and businesses could deal with paying a tax that covers up three or four years in one payment.

Such pressure has the potential of encouraging people to migrate overseas, he warned. Senator Qadir blamed the Federal Board of Revenue (FBR) for its “harassing approach” and proposed to collect the tax in smaller amounts in two to three years.

Sustainability of Revenue Measures

Senator Sherry Rehman echoed concerns for the super tax strategy. She pointed out that the constitutional court had made it clear that the parliament has power to impose this tax.

However, she cautioned that it is not sustainable to tax the same group of people over and over again to raise more money. This will add to the financial burden on citizens.

FBR Offers Flexibility

Responding to the feedback, the FBR chairman said that in some cases instalment options could be allowed. He informed that total super tax collection has reached a level of Rs217 billion.

The chairman also commented that the tax-related alerts sent through calls and messages helped bring another one million taxpayers under registration.

Finance Minister added that he had received such messages from FBR himself.

The session reflected some significant reflections regarding currency reforms and taxes policies while pointing out the increasing concerns about economic constraints for the citizenry and the enterprises.

Also read: When will SBP issue new currency notes?